August 1, 2024

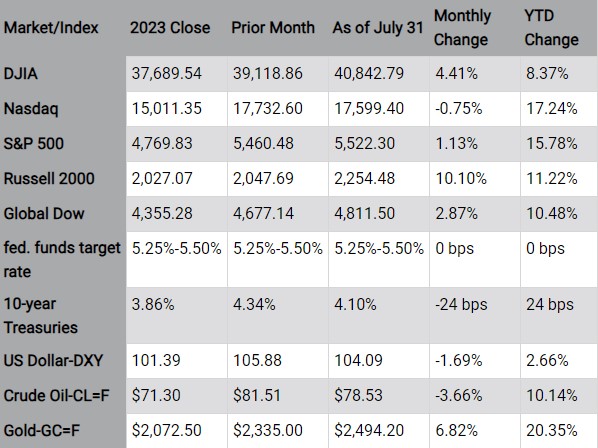

The Markets (as of market close July 31, 2024)

Inflationary data showed price pressures stabilized in June. The 12-month interest rates of the Consumer Price Index and the Personal Consumption Expenditures (PCE) Price Index declined. Prices for commodities that are prevalent for most households, such as food at home, gasoline, new and used motor vehicles, and apparel, changed very little over the year. The PCE price index, the preferred barometer of the Federal Reserve, slowed to 2.5% for the year ended in June as it inches closer to the Fed's 2.0% target inflation rate.

Growth of the U.S. economy continued at a modest pace, despite the Fed's restrictive monetary policy. The gross domestic product (GDP) exceeded expectations after increasing 2.8% in the second quarter, following a 1.4% increase in the first quarter. Consumer spending, the largest contributor in the calculation of GDP, rose 2.8%, with spending rising in durable goods, nondurable goods, and services. Private investments, another key component of GDP, also increased. Consumer confidence grew in July after trending lower in May.

Job growth notably slowed over the past several months. Although job gains exceeded expectations in June, downward revisions to estimates for April and May clearly show that average monthly gains in the second quarter of the year (177,000) are well below the average gains in the first quarter (267,000). Wage growth has changed little throughout the year. The 12-month rate for the period ended in June (3.9%) was only 0.2 percentage points lower than the rate for the period ended in May. New weekly unemployment claims decreased from a year ago, while total claims paid increased.

Nearing the midpoint of Q2 corporate earnings season, S&P 500 companies are reporting mixed results. About 41% of the S&P 500 companies have reported results. Of those companies, 78% reported earnings per share (EPS) above estimates, which is in line with the five-year average of 77% and higher than the 10-year average of 74%. Overall, as of July 26, the index reported an earnings growth rate of 9.8%, which is above the 8.9% growth rate for the three months ended in June. Eight of the 11 sectors are reporting year-over-year growth, with four of these eight sectors reporting double-digit growth: communication services, information technology, financials, and health care. On the other hand, three sectors are reporting a year-over-year decline in earnings, led by the Materials sector.

Sales of both existing homes and new homes declined in July. Higher mortgage rates have slowed sales, with inventory expanding and the sales process lengthening. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.77% as of July 18. That's down from 6.89% one week ago and 6.78% one year ago.

Industrial production expanded in June for the second straight month. Manufacturing output increased in June and was 1.1% above its year-earlier level. Within manufacturing, durable manufacturing was unchanged in June, while nondurable manufacturing increased 0.8%. According to the latest survey from the S&P Global US Manufacturing Purchasing Managers' Index™, the manufacturing sector perked up in June, while the services sector saw business accelerate at a quicker pace than in May.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark the performance of specific investments.

Looking ahead

All eyes will be on the inflation data released in August for July. Inflationary pressures resumed a downward trend, and if it continues, the Fed, which does not meet in August, may be more inclined to lower interest rates when it meets next in September.

Data sources: Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI, Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates). News items are based on reports from multiple commonly available international news sources (i.e., wire services) and are independently verified when necessary with secondary sources such as government agencies, corporate press releases, or trade organizations. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Forecasts are based on current conditions, subject to change, and may not come to pass. U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. The principal value of Treasury securities and other bonds fluctuates with market conditions. Bonds are subject to inflation, interest-rate, and credit risks. As interest rates rise, bond prices typically fall. A bond sold or redeemed prior to maturity may be subject to loss. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.

IMPORTANT DISCLOSURES Camden National Wealth Management does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual's personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Trust and investment management services are provided by Camden National Bank, a national bank with fiduciary powers. Camden National Bank is a wholly owned subsidiary of Camden National Corporation. Camden National Bank does not provide tax, accounting or legal advice. Please consult your accountant and/or attorney for tax and legal advice.

Investment solutions such as stocks, bonds and mutual funds are:

"NOT A DEPOSIT • NOT FDIC INSURED • NOT GUARANTEED BY THE BANK • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • MAY LOSE VALUE"