April 1, 2025

The Markets (first quarter through March 31, 2025)

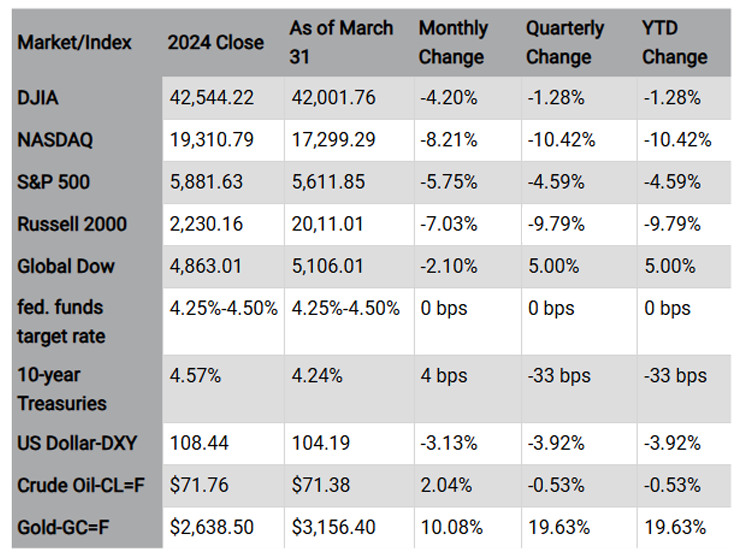

Wall Street got off to a good start to begin the first quarter of 2025 and continued to rally for much of the quarter. Several of the benchmark indexes reached record highs in January through mid-February. However, U.S. stocks closed the first quarter in a tailspin, unable to keep pace with major global stocks. Following the presidential election, investors began the quarter hopeful that the new administration would encourage economic growth and lasso inflation. However, the Trump administration embarked on an economic policy that threatened or imposed tariffs on goods from major trade partners including Canada, Mexico, and China, as well as the European Union.

Throughout March, investors worried about the impact of a trade war, rising inflation, and a potential economic recession. Both the personal consumption expenditures (PCE) price index and the Consumer Price Index (CPI) moved little for much of the quarter, however, core prices (excluding volatile food and energy segments) increased on an annual basis, moving farther from the Federal Reserve's 2.0% target rate. In response, the Federal Reserve maintained the federal funds target rate range at 4.25%-4.50%. The unemployment rate edged up to 4.1% in February. In this context, U.S. stocks declined in March and for the quarter. The S&P 500 lost nearly 5.0%, while the NASDAQ declined over 10.0%.

Among the market sectors, the first quarter saw consumer discretionary fall more than 16%, information technology decline about 15%, and communication services drop nearly 8%. On the other hand, energy outperformed by a large margin, gaining more than 10% from the beginning of the year. Rising bond prices weighed on yields, with the yield on 10-year Treasuries closing lower in each month of the quarter as investors sought safety amid escalating trade tensions. The yield on the 2-year note ended the quarter at about 3.92%, a decrease of 28 basis points from the beginning of the quarter. By the end of the quarter, nearly 70 S&P 500 companies reported negative earnings per share, which is above the five-year average of 57 and higher than the 10-year average of 62. According to FactSet, the number of companies issuing positive earnings per share is below the five-year average but a tick above the 10-year average.

Gold, considered a safe haven during volatile economic times, had its best quarter since 1986 after rising nearly 20% in the first quarter as the potential trade war and economic slowdown sent worried investors scurrying for more stable investments. Crude oil prices fluctuated throughout much of the quarter, ultimately ending up about where they began. Moving forward, a new round of tariffs set to take effect during the first week of April, could heighten fears of a global trade war, which could slow economic growth and curtail demand for energy. The retail price for regular gasoline was $3.115 per gallon on March 24, $0.010 below the price a month earlier but $0.072 more than the price at the beginning of the first quarter. Regular retail gas prices decreased $0.408 from a year ago. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.65% as of March 13. That's up from 6.63% one week ago but down from 6.74% one year ago

January began the year and the first quarter on a high note. Stocks moved generally higher, with each of the benchmark indexes listed here closing higher. The S&P 500 gained 2.7%, the NASDAQ climbed 1.6%, and the Dow rose 4.7%. The Federal Reserve met in January and held the key policy rate at 4.25%-4.50% following three consecutive rate cuts. The yields on 10-year Treasuries closed at 4.56% after climbing to 4.8% mid-month. Inflation proved stubborn as both the CPI and the PCE price index increased year over year. Throughout the month, investors tried to digest the plethora of executive orders signed by President Trump. In addition, the administration imposed new tariffs on Canada, Mexico, and China, creating uncertainty around global trade relations. While most of the market sectors closed higher, tech shares took a hit as a new Chinese AI company shook the industry.

Stocks ended February lower, with information technology, consumer discretionary, communications, and industrials underperforming. Bond prices climbed higher, pulling yields lower. The dollar index ticked lower, while gold prices moved modestly higher. Crude oil prices fell nearly 5% in February, marking the first monthly loss since November 2024. President Trump's policies relative to tariffs, immigration, taxes, the Middle East, and the Ukraine/Russia conflict weighed on market sentiment. Mixed economic data and a hotter-than-expected CPI added to concerns of recession and stagflation. Ten-year Treasury yields fell 36 basis points.

The market volatility that began in February increased in March. Tariffs, persistent inflation, and the threat of global economic turmoil hit investors hard. Consumer confidence trended lower, notably future expectations, which fell to a 12-year low to a rate that could signal an economic recession. Each of the benchmark indexes declined in value, with the NASDAQ falling more than 8%. The energy sector was the only one to close March in the black. The remaining market sectors trended lower, with communication services and information technology underperforming notably. The dollar index declined under the weight of economic uncertainty. Gold prices, on the other hand, reached a record high. Crude oil prices moved higher after President Trump intimated that additional tariffs on Russia could be in the offing, which could lead to supply concerns.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark the performance of specific investments.

Looking ahead

The Federal Reserve does not meet in April, so there will be some time to determine the impact of President Trump's economic policy and tariffs.

Data sources: Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI, Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates). News items are based on reports from multiple commonly available international news sources (i.e., wire services) and are independently verified when necessary with secondary sources such as government agencies, corporate press releases, or trade organizations. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Forecasts are based on current conditions, subject to change, and may not come to pass. U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. The principal value of Treasury securities and other bonds fluctuates with market conditions. Bonds are subject to inflation, interest-rate, and credit risks. As interest rates rise, bond prices typically fall. A bond sold or redeemed prior to maturity may be subject to loss. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.

IMPORTANT DISCLOSURES Camden National Wealth Management does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual's personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Trust and investment management services are provided by Camden National Bank, a national bank with fiduciary powers. Camden National Bank is a wholly owned subsidiary of Camden National Corporation. Camden National Bank does not provide tax, accounting or legal advice. Please consult your accountant and/or attorney for tax and legal advice.

Investment solutions such as stocks, bonds and mutual funds are:

"NOT A DEPOSIT • NOT FDIC INSURED • NOT GUARANTEED BY THE BANK • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • MAY LOSE VALUE"